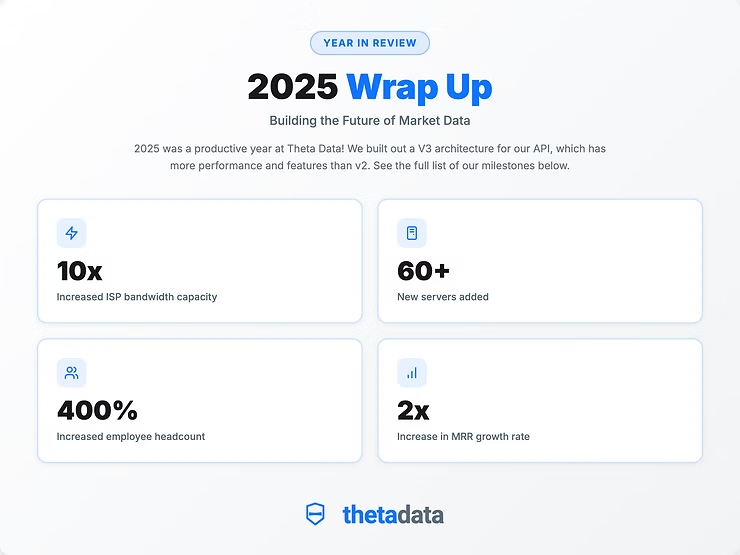

2025 Wrap Up

Read More →

MCP Now in Terminal v3 (beta)

Read More →

REST API V3 (beta)

Read More →

Flat Files (beta)

Read More →

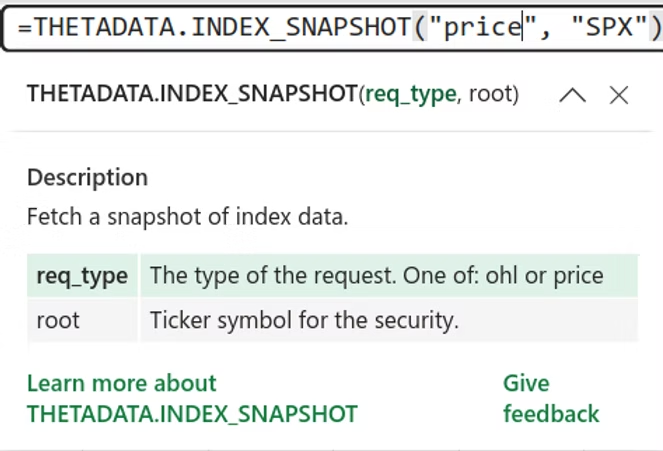

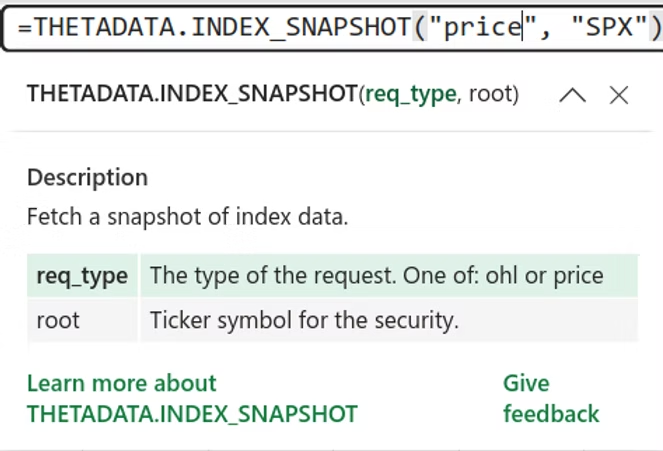

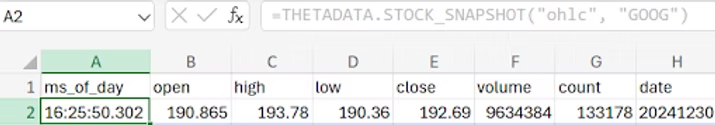

Theta Data in Excel!

Read More →

Weekend Snapshot Availability & More!

Read More →

Theta Data Integration with LEAN CLI

Read More →

Live Stocks Data, Dividends & More Features!

Read More →

API Townhall This Friday

Read More →

Theta Data Launches New Indices API

Read More →

CSV Support & Bulk EOD Greeks

Read More →

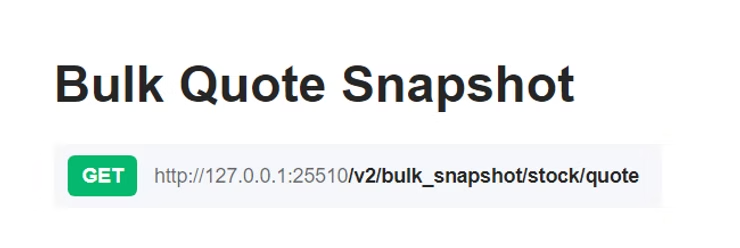

REST API & Bulk Snapshots

Read More →

Ho Ho Ho, Refer a Friend and Get $10!

Read More →

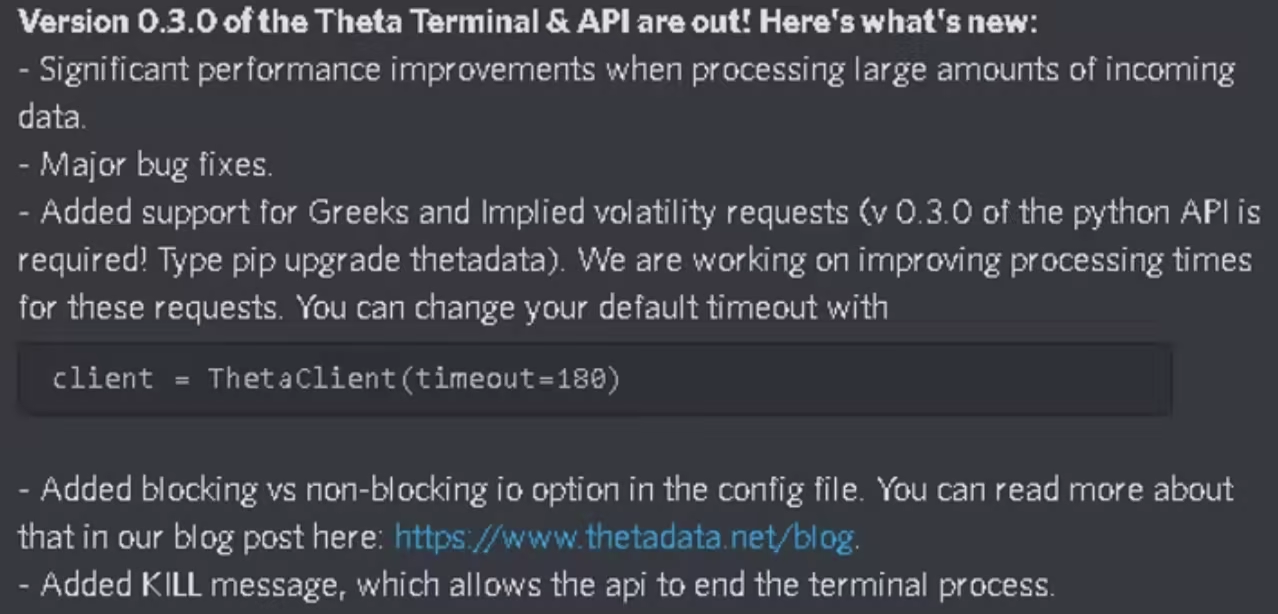

Free Historical Options Data + New API Features

Read More →